Doing business in Nicaragua

How quickly can I set up a business?

A regular business can be set up entirely in 3 weeks or 15 business days.

What is the minimum investment needed?

The minimum investment to make is an approximately U$ 1,410.00 US dollars (Registration fees included).

How can I raise finance?

Financing projects are directed to family businesses through cooperatives, microfinance institutions and/or state projects.

If a formal company, you may apply for bank financing. If from Italy, France, Spain, Germany, you may find support for your business in locally constituted ‘Chambers’ to create contacts, find investors and also for advertising and promotion.

What are the legal requirements for setting up my business?

Regulations don´t allow unipersonal companies. You need at least 2 shareholders.

You can choose from: Establishment (a branch of your overseas business structure but constituted as one of the below structures: Anonymous Partnership, Joint Partnership with Limited Liability, Limited Partnerships with a share capital and Limited Liability Partnership)

You can also constitute a subsidiary of your foreign pre-established business.

What structure should I consider?

The structure you should choose depends on your type of business and also on how you want to conduct your operations. The usual choice of investors is the Stock Corporation.

What advice can you give me in regards to payroll and taxation requirements?

Current Personal Income Tax rates in Nicaragua are:

| Band of Annual Net Income

C$ |

Base tax

C$ |

Applicable percentage | Over the excess of

C$ |

| 0.01 – 100,000.00 | 0 | 0.00% | 0 |

| 100,000.01 – 200,000.00 | 0 | 15.00% | 100,000.00 |

| 200,000.01 – 350,000.00 | 15,000.00 | 20.00% | 200,000.00 |

| 350,000.01 – 500,000.00 | 45,000.00 | 25.00% | 350,000.00 |

| 500.000.01 – a más | 82,500.00 | 30.00% | 500,000.00 |

Employers and employees also have to pay Nicaragua social security, which is called “Social Security”.

Current Social Security rates are:

| Disablement, Old age and Death and

Professional risks |

Illness and maternity | War victims | Total | |

| Employer | 15.00% | 6.00% | 1.5% | 22.5% |

| Employee | 4.75% | 2.25% | 7 % | |

| State | 1.75% | 1.75% | ||

| Total | 21.5% | |||

It is the employers’ legal responsibility to pay over employee’s tax and social security deductions to the Nicaraguan tax authorities. The retention is made by the employer directly from the employee’s salary and reports it to the Social Security Institute.

Also, there is a retention rate of 20% for non-residents working locally.

How can Kreston grow your business?

Select your business type:

- Afiliarse

- Buscar un lugar

- Conocimientos

- Encuentra una empresa

- Establecer un negocio en Argentina

- Gracias

- Inicio

- La encuesta Interpreneur: Tendencias empresariales globales del mercado medio

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Brasil

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en China

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en el Reino Unido

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en España

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Estados Unidos

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Francia

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Nigeria

- La encuesta Interpreneur: Comprender las tendencias del mercado empresarial medio en la India

- La encuesta Interpreneur: Comprendiendo las tendencias de las empresas medianas en México

- La encuesta Interpreneur: Entender las tendencias de las empresas medianas en Alemania

- La encuesta Interpreneur: Entender las tendencias de las empresas medianas en Egipto

- La encuesta Interpreneur: Entender las tendencias de las empresas medianas en Sudáfrica

- La encuesta Interpreneur: Entender las tendencias del mercado empresarial medio en los EAU

- Noticias

- Asesoría

- Auditoría y seguros

- Ciencias de la vida y sanidad

- Contabilidad

- Energía

- ESG

- Fabricación y automoción

- Finanzas

- Fiscalidad

- Inmobiliario y Construcción

- Movilidad mundial

- Organizaciones benéficas sin ánimo de lucro y educación

- Servicios de precios de transferencia

- Subcontratación

- Tecnología, Medios de Comunicación y Telecomunicaciones

- Venta al por menor

- Nuestra red

- Nuestros sectores

- Ciencias de la vida y sanidad

- Energía, servicios públicos y recursos

- Industria manufacturera y del automóvil

- Inmobiliario y construcción

- Ocio y hostelería

- Organizaciones benéficas, sin ánimo de lucro y educación

- Servicios financieros

- Tecnología, medios de comunicación y telecomunicaciones

- Transporte y logística

- Venta al por menor

- Nuestros servicios

- Auditoría y seguros

- Externalización de servicios

- Impuestos indirectos

- Servicios contables

- Servicios de asesoramiento

- Asesoramiento en reestructuración empresarial e insolvencia

- Consultoría informática y servicios de ciberseguridad

- Consultoría Medioambiental, Social y de Gobernanza

- Independent Business Review

- Servicios contra el fraude empresarial

- Servicios de asesoramiento en finanzas corporativas

- Servicios de asesoramiento en RRHH

- Servicios de asesoramiento en TI y ciberseguridad

- Asesoramiento y apoyo financiero a empresas

- Servicios fiscales

- Recuperación de los costes de capital

- Estructuración fiscal para multinacionales

- Fiscalidad de particulares

- Incentivos fiscales a la investigación y el desarrollo (I+D)

- Movilidad mundial

- Servicios jurídicos para empresas

- Cumplimiento fiscal para las empresas

- Digitalización fiscal

- Planificación fiscal para empresarios

- Precios de transferencia

- Póngase en contacto con nosotros

- Quiénes somos

Latest news

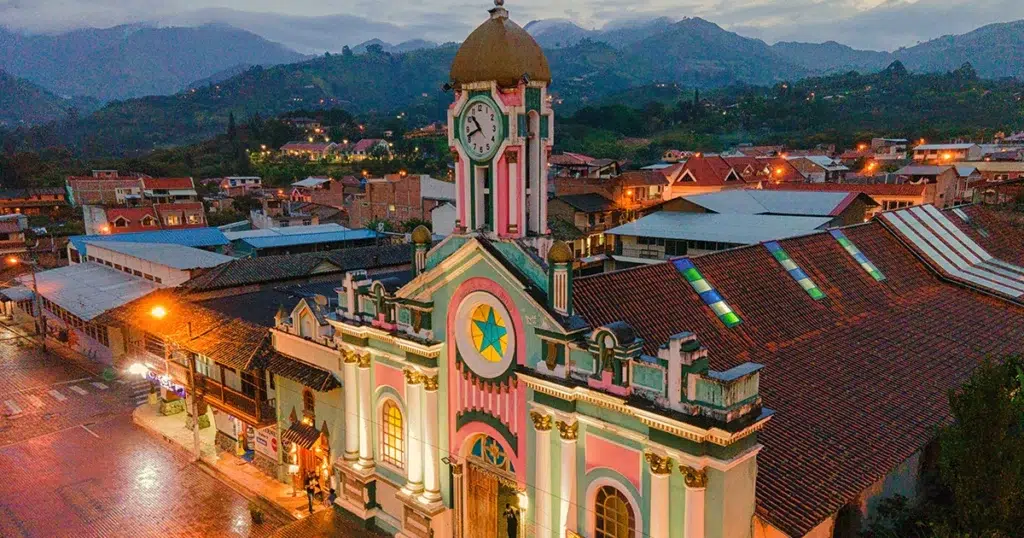

Aumento del IVA en Ecuador en 2024

Ecuador verá aumentar los tipos del IVA en 2024 para hacer frente a un déficit de 5.000 millones de dólares, impulsado en parte por la reducción de la producción de petróleo y el aumento del gasto para hacer frente a los continuos disturbios en el país. La subida también satisface un nuevo acuerdo de financiación con el Fondo Monetario Internacional.

Kreston ATC Chile se une a la red

Kreston ATC Chile se complace en formar parte de Kreston Global. El objetivo: ser la mejor empresa para todas las empresas locales e internacionales.