Doing business in Mexico

- How quickly can I set up a business?

- What is the minimum investment needed?

- How can I raise finance?

- What are the legal requirements for setting up my business?

- What structure should I consider?

- What advice can you give me in regards to payroll and taxation requirements?

- Is there anything else that I should know?

How quickly can I set up a business?

Obtain the permit/authorization to use the corporate/legal name for the new Mexican company with the Ministry of Economy (3-7 days).

Power of Attorney (PoAs) from foreign shareholders and by-laws (1-1.5 weeks).

Execute and obtain an Act of Incorporation (public deed) with the Mexican Notary Public (2-3 weeks).

Register the public deed with the Public Registry of Commerce “RPC” (1-4 weeks, such time will depend entirely on the availability of the RPC).

Register the new company in the National Registry of Foreign Investments (10 business days upon the registration in the RPC is completed).

Register the new company with the Tax Authority and Social Security Authority (1 week).

What is the minimum investment needed?

Mexican Law does not require a minimum of stock capital. All that is required are two shareholders/partners and each one must subscribe/hold at least one share/equity interest.

(For “Sociedades Anónimas [S.A.]” the minimum capital stock of the company should be, at least, $0.02 cents of peso, derived from the fact that a minimum of two shareholders are required [minimum one cent per each shareholder]; for “Responsabilidad Limitada [S. de R.L.]” the minimum social capital of the company should be, at least, $2.00 pesos, derived from the fact that a minimum of two partners are required [one peso per partner]).

There is a type of single-shareholder corporation (Single Member Company) known as “Sociedades por Acciones Simplificadas [S.A.S.]” but the characteristic of such entities are not usually compatible with corporate groups.

How can I raise finance?

The shareholders/partners must contribute the entire capital.

They could contribute money or assets/goods.

The contributions can be granted/invested at the moment of the incorporation or later, but in S.A. type of entities at least 20% have to be granted at the incorporation and for S. de R.L. type of entities 50%.

What are the legal requirements for setting up my business?

1. Verify the viability of the proposed company’s corporate purpose/activity/core business according to the Foreign Investments Law.

2. Obtain the permits to use the corporate name for the new Mexican company with the Ministry of Economy.

3. Process the Power of Attorney (PoAs) from the foreign shareholders for the incorporation, as well as the Act of Incorporation of such (or other document that proves its legal existence [for legal entities]), duly notarized and apostilled in the country of residence.

4. Obtain official translations over the foreign documents and apostille seals/certificates.

5. Determine capital stock structure, administration body and proxies and process by-laws in order to execute the Act of Incorporation with the Mexican Notary Public.

6. Start with the registration process with the RPC.

7. Obtain the Mexican Tax ID number (“RFC”) and the electronic signatures and passwords.

8. Open bank accounts.

9. Obtain authorizations, permits, licences and other equivalents applicable to the industry of the new Mexican company to be able to operate and for the use of real estate property.

10. Register the company before social security/labor authorities.

11. Prepare and keep corporate records:

a. Shareholders’ Meetings Minutes Registry Book.

b. Shareholders’ Registry Book.

c. Capital Stock Variations Book.

d. Registry of the Board of Directors Meeting Minutes.

e. Share Certificates.

12. Notify the Ministry of Economy the capital stock structure through its electronic platform.

13. Register in the National Registry of Foreign Investments.

What structure should I consider?

Recommended type of Mexican companies:

“Sociedad de Responsabilidad Limitada” (Limited Liability Company) recommended for corporate groups:

It requires fewer operative formalities than a S.A., but it requires more formalities for the transfer of equity interests and admission of new partners.

It is represented by indivisible and non-negotiable equity interests (no shares).

Each partner has one equity interest and its value will depend on the contributions he/she/it grant. The equity interest can only be divided, corporate rights permitting (e.g., economic or voting rights only).

The responsibility of the partners is limited to the amount of their respective contributions.

Maximum 50 partners.

It must approve financial statements on an annual basis.

Optional statutory auditor; not mandatory.

Optional equity interest certificates; not mandatory.

Administrated by “managers” (single manager or board of managers).

“Sociedad Anónima” (Corporation) recommended for independent investors (not related):

It has more operative formalities than a S. de R.L., but it is easier to sell and transfer shares.

Its capital stock is represented by shares.

It prioritizes capital over people and may issue different series or classes of shares for purely capitalistic shareholders.

It is a more regulated type of company, which can generate greater stability and confidence.

It must approve financial statements on an annual basis.

Mandatory statutory auditor, not optional.

Mandatory share certificates, not optional.

Administrated by “Managers” (Single Manager or Board of Managers).

Establishment (a branch of your overseas business):

• Not a separate legal entity but an extension of the overseas parent company.

• Permits/authorizations before the National Registry of Foreign Investments are required.

What advice can you give me in regards to payroll and taxation requirements?

Personal Income Tax:

• Taxpayers considered resident in Mexico are liable for Mexican tax on their worldwide income.

• Current Personal Income Tax rates in Spain are in between 0% and 35%

Social Security:

Employers and workers also have to pay the fees regarding the insurance of the mandatory regime according to Social Security Law. In general terms, the current percentage of the payment made by the employer can be up to 38.73% and 2.775% for the worker.

Employers must consider that when setting up a work relationship with foreign subordinates, they acquire the quality of insurance subjects before the Mandatory Regime of Social Security of the IMSS, since there is no provision that excludes them from such right.

Corporate Income Tax:

Current Corporation Tax rates in Mexico is: 30%.

VAT:

VAT is a “goods and services tax”, the standard rate of which is 16%. If a company makes taxable activities, then it must pay VAT.

Vat taxable entrepreneurs are obliged to submit monthly VAT return. The deadline for the submission of the return is the 17th of each month.

Compliance requirements:

The presentation of all tax returns by companies must be by electronic means, for which a digital certificate is required.

Is there anything else that I should know?

In order to incorporate a new Mexican company, the advisors and the notaries have to identify the client for anti-money laundering purposes. Know Your Customer (KYC) processes will apply to the foreign shareholders.

Compliance:

• Outsourcing.

• Data Privacy.

• Anti-money Laundering.

• Anticorruption.

• Foreign Investments.

• Secretarial.

Our firms in Mexico

How can Kreston grow your business?

Select your business type:

- Afiliarse

- África

- América Latina

- Asia-Pacífico

- Buscar un lugar

- Ciencias de la vida y sanidad

- Conocimientos

- Encuentra una empresa

- Energía, servicios públicos y recursos

- Establecer un negocio en Argentina

- Europa

- Gracias

- Industria manufacturera y del automóvil

- Inicio

- Inmobiliario y construcción

- La encuesta Interpreneur: Tendencias empresariales globales del mercado medio

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Brasil

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en China

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en el Reino Unido

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en España

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Estados Unidos

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Francia

- La encuesta Interpreneur: Comprender las tendencias de las empresas medianas en Nigeria

- La encuesta Interpreneur: Comprender las tendencias del mercado empresarial medio en la India

- La encuesta Interpreneur: Comprendiendo las tendencias de las empresas medianas en México

- La encuesta Interpreneur: Entender las tendencias de las empresas medianas en Alemania

- La encuesta Interpreneur: Entender las tendencias de las empresas medianas en Egipto

- La encuesta Interpreneur: Entender las tendencias de las empresas medianas en Sudáfrica

- La encuesta Interpreneur: Entender las tendencias del mercado empresarial medio en los EAU

- Norteamérica

- Noticias

- Asesoría

- Auditoría y seguros

- Ciencias de la vida y sanidad

- Contabilidad

- Energía

- ESG

- Fabricación y automoción

- Finanzas

- Fiscalidad

- Inmobiliario y Construcción

- Movilidad mundial

- Organizaciones benéficas sin ánimo de lucro y educación

- Servicios de precios de transferencia

- Subcontratación

- Tecnología, Medios de Comunicación y Telecomunicaciones

- Venta al por menor

- Nuestros servicios

- Auditoría y seguros

- Externalización de servicios

- Impuestos indirectos

- Servicios contables

- Servicios de asesoramiento

- Asesoramiento en reestructuración empresarial e insolvencia

- Consultoría informática y servicios de ciberseguridad

- Consultoría Medioambiental, Social y de Gobernanza

- Independent Business Review

- Servicios contra el fraude empresarial

- Servicios de asesoramiento en finanzas corporativas

- Servicios de asesoramiento en RRHH

- Servicios de asesoramiento en TI y ciberseguridad

- Asesoramiento y apoyo financiero a empresas

- Servicios fiscales

- Recuperación de los costes de capital

- Estructuración fiscal para multinacionales

- Fiscalidad de particulares

- Incentivos fiscales a la investigación y el desarrollo (I+D)

- Movilidad mundial

- Servicios jurídicos para empresas

- Cumplimiento fiscal para las empresas

- Digitalización fiscal

- Planificación fiscal para empresarios

- Precios de transferencia

- Ocio y hostelería

- Organizaciones benéficas, sin ánimo de lucro y educación

- Oriente Medio

- Póngase en contacto con nosotros

- Quiénes somos

- Servicios financieros

- Tecnología, medios de comunicación y telecomunicaciones

- Transporte y logística

- Venta al por menor

Latest news

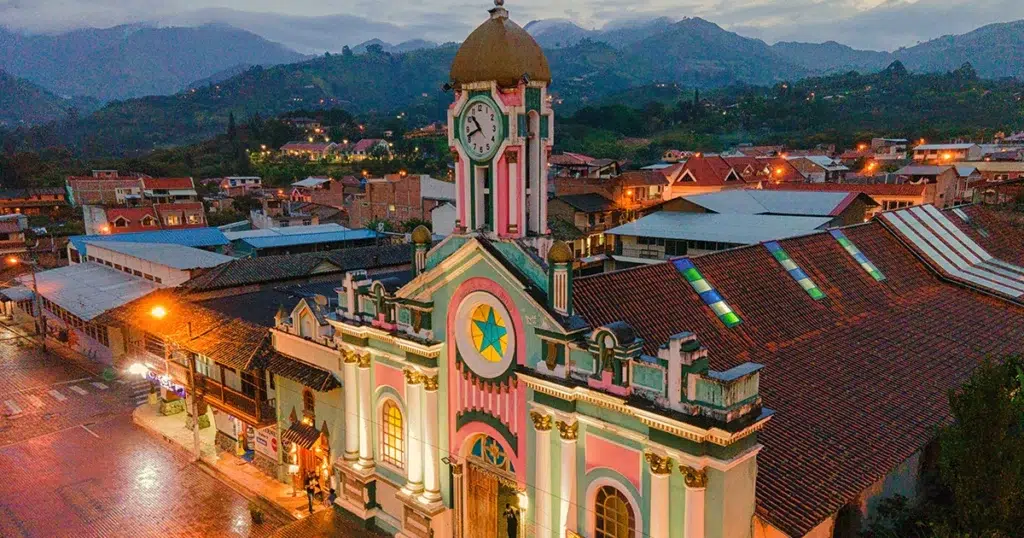

Aumento del IVA en Ecuador en 2024

Ecuador verá aumentar los tipos del IVA en 2024 para hacer frente a un déficit de 5.000 millones de dólares, impulsado en parte por la reducción de la producción de petróleo y el aumento del gasto para hacer frente a los continuos disturbios en el país. La subida también satisface un nuevo acuerdo de financiación con el Fondo Monetario Internacional.

Kreston ATC Chile se une a la red

Kreston ATC Chile se complace en formar parte de Kreston Global. El objetivo: ser la mejor firma para todas las empresas locales e internacionales.